So I have often been asked “How do you have the money to travel so much”?

Well, to be honest, and fair, a well-paying job helps. 🙂

But that’s not really it. I know people who earn much more than I do, who profess to love travel, and yet who never to seem to have the money to travel. On the other side, I also know people who earn a lot less than I do, and who have seen a lot more of the world that I have. So what separates the two categories of people? The will! Yes, as cliche as it sounds, if you really want to do, you will find a way to do it.

Having said that, there are a number of things you could do to manage your finances better, while planning for a trip, or even while you are on the trip. So there’s quite a lot of material on the internet on this topic, but I found that it didn’t really apply much for Indian travelers wishing to going abroad. We don’t deal in dollars, and our lifestyles are quite different, and more importantly, the way we spend our money is quite different.

With the caveat that I know that within India, we have completely different set of lifestyles, here are a few ways I save money which helps my travel funds.

1. Deals! – So the advantage of living in a capitalistic and highly consumerist society is that you are flooded with deals almost every single day. And when I say deals, I don’t mean the standard 50% sign you see in front of showrooms; there are much better deals out there if you only deign to look carefully. For instance – movie tickets! So I know most of my friends watch movies on weekends, and spend a minimum of Rs500 per person on tickets, food and parking. Me? I watch movies only on weekdays at the princely cost of Rs 120, and bit more on food maybe. But with a family of four, or even as a couple – look at the the math, and the amount of money saved. Almost 2k over a month, which could be the price of a room in Cambodia! And more importantly, I get to avoid the crowds and the traffic. and spend my weekends on things like drives or smaller trips!And there’s many such deals out there – you only need to consider them. Yes, it’s being bit of a cheapskate, but the trade-off is worth it, 🙂

2. Gadgets – So yes, I have a fancy smart phone, but it was a gift from the husband. And yes, I have a Samsung tab, which I absolutely adore, but it’s the only gadget for which I have paid some serious money. More importantly, it’s really useful to have a smartphone while travelling, and a tab to jot down all my travel notes. So those are my excuses, and I stand by them. So what’s yours? So did you really need to change that phone right away? Exchange that TV for a 3D one? Buy that second laptop? Don’t get me wrong. I love all these fancy gadgets, and I especially drool at the sight of big 60 inch television screens, but the question is ..do I really need it that much? And would the money be better spent on something like. ummm..a kickass experience? I know what you are thinking – now that kind of scrimping is not fun. It’s not, but hey, nobody is asking you to cut down on things you really like. So yes, you enjoy your morning tea with Karnatak music, and I wouldn’t begrudge you that lovely home theater system you installed. But do you really need to change it after 6 months, and pay 35k on it? That’s the price of a holiday in Thailand.

3. Eating out – Okay, so before anyone comments, I have to admit, there is one area where I do not score well at all. If you have seen my size, you would know how much of a glutton I am, and how much I love eating out. And it’s not even the food. I enjoy the experience of sitting in nice restaurants, having long conversations over drinks, lazing about in coffee shops and all that jazz. So I am not going to tell you to avoid all that. If I can indulge, so can you 🙂 But even here, there are smarter ways of managing your bills. Like? Well, for instance, are you aware of the “By two soup” scam? Now, this is a practice, I have seen only in India, and that too in south India, but basically the concept is this – two of you order the same soup, and request it to be served “by two”. What this means is that you have asked for the half the quantity of soup, but in practice, you get two almost-full bowls of soup. Think 5 star places are horrendously expensive? Well, most of the times they are. The exception? Pizza. A lot of 5-star places offer a large scrumptious thin crust pizza for Rs 600-700, almost the same price as a Dominoes or Pizza hut. Share it as a couple in really nice surroundings, and you will forget that you are a cheapskate! 🙂 More you ask? Well, do you always have to do the whole 4 course dinner thing, especially with the quantity being served in Indian food? Sometimes it’s perfectly fine to dive into that biryani without the soup and the starters!

4. Phone bills – Again, I am not asking you to stop talking to people. But check with your telephone provider if you are getting the best plan suitable for your calling pattern. For instance, I realized that a lot of bill consisting of roaming charges when I am at home in Kerala. After calling up Vodafone, I realized that I could take a pack which costed 75 bucks, but would make all incoming calls free for me. My phone bill reduced by 30%.

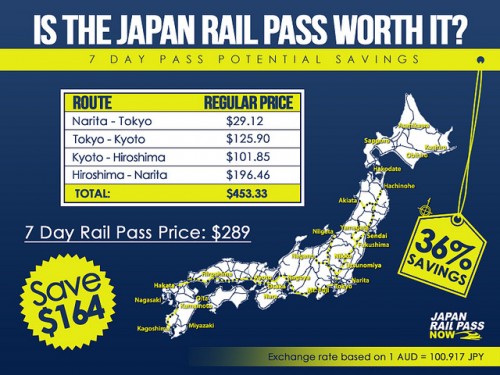

5. Public transport – So I won’t recommend using public transport in Bangalore. Well, maybe even in Bangalore. If you get those big Volvo buses, why not? They are comfortable, and cheaper than your car, and you avoid the hassle of driving. But if you are in places with good public transport, use it wisely. And on a trip abroad, always, always use public transport..except in places where it doesn’t exist like the US or the middle east of course! If you are in Europe, or even south east Asia, travelling on trains and buses is quite economical and an excellent way of viewing the country!

6. Research – This is really important, and the reason is that knowledge is power, and more importantly money. The problem is…most of us assume. We assume that it’s going to be expensive, and beyond our means. It might in some cases, but how would you know unless you even try to find out? And in the age of Google, this is the easiest thing to do. There are so many websites which help you with flight bookings, hotels, and tours – all you need to do is..spend some time looking at the different options available, and you will find something which fits your budget. This of course doesn’t mean that you could do a trip to Europe with 50k, but it would possibly give you ideas of places you could go for 50k, or maybe places in europe for 70k? Knowledge earned is money saved.

7. Online Shopping – Yes, I am serious. You get some fantastic deals while shopping online, so I would totally recommend it. But if you are like me, you could go overboard as well, and buy things you don’t need. My trick – choose the item I want, add it to the cart, and leave it there for a day or two. Most often, I don’t want it after two days. 🙂

8. Recurring deposits and Fixed deposits – Okay, I don’t have a recurring deposit, but I do know that I have to keep some money kept aside for my travel plans. Over the years, it been an automatic response to ensure that I have some cash kept aside at the end of the month. I like to call it my backup cash for emergencies, but I know in my heart that it’s going into my next trip, and I watch it grow and blossom with eager anticipation. 🙂 Fixed deposits are not ideal investments, but in some cases, I believe they are quite beneficial. These days a lot of banks allow you to create online FDs, if you have extra cash lying in your account. For example, HDFC has a scheme where you can keep a fixed amount in your account, and if you have more than that lying around, it immediately gets transferred to an FD, which gives you a decent 8.75% percent interest. Well, I know it’s not ideal, but better than it lying around in that account, and you spending it on things you didn’t really need.

9. Plan well – Plan your trip in advance, and you could save a serious amount of money on your trip. Airlines and hotels both give you some really good deals. This morning I was looking for deals to Europe, and I found a flight to Prague in March end for 35k. My flight to Jordan and Egypt was 29k because I booked it quite early. Avoid high season or festival timings – high traffic means high prices.

10. Take the plunge – Go ahead. Just take the plunge. Go. Yes, I know the money situation is not the best, you are not ready, it will get better if you only wait for one year. Doesn’t matter. When I did my first overseas trip to Australia, I was 22, and I returned home to a bank account which had Rs 83. I don’t quite remember how I survived till my next salary, but I did. We had money issues on the trip as well. Our last day in Sydney, we didn’t have money for food, so we took the Kellogg cereal packs from the breakfast buffet and had them for lunch. For dinner, L and me went to a McDonalds, where my card got declined for 4 dollars. We then shared a green apple as we wandered around the streets of Sydney. But hey, it passed. 13 years later, and several journeys later, it seems okay, something to laugh about. My finances got better, I learnt to plan better, but more importantly, I learnt to love travel. Had I never taken the plunge then, I can guarantee that my life would have been drastically different.

P.S: As a last note, I do have to say that I know that a lot of people really do not have finances to travel. All these tips make no impact for the guy who’s making ends meet. Or for the guy who has serious family commitments. But if you do have the option, and if it’s something you really want to do, I hope these tips help you.

P.P.S: I know this is a really cheapskate post, but what the heck! Happy traveling! 🙂

4 comments for “How to save money while traveling”